Compounded annuity formula

This video explains how to derive the value of an annuity formula using the case when deposits are made annually with interest compounded annuallySite. The formula is as.

Future Value Of An Annuity Due Double Entry Bookkeeping

A Fixed Annuity May Provide A Very Secure Tax-Deferred Investment.

. Brought to you by. PV of an Annuity Due PV of Ordinary Annuity 1i Multiplying the PV of an ordinary annuity with 1i shifts the cash flows one period back towards time zero. The future value of a particular annuity with continuous compounding abbreviated at FVA is calculated using the following annuity formula continuous compounding formula.

Monthly Compound Interest 3414083. Instead we can use the annuity equation as follows. The present value PV of an annuity with continuous compounding formula is used to calculate the initial value of a series of a periodic payments when the rate is continuously compounded.

Learn some startling facts. FVA CF X. In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of.

Ad Learn More about How Annuities Work from Fidelity. Learn More On AARP. The sum of cash flows with continuous compounding can be shown as.

Ad Learn More about How Annuities Work from Fidelity. FV 1000 1 008 3 1. To calculate the compounded annually formula you will need to know the.

However with any annuity of significant length such a tactic would be impractical and extremely tedious. The future value of annuity with continuous compounding formula is the sum of future cash flows with interest. Monthly Compound Interest P 1 R 1212t P.

Ad A Calculator To Help You Decide How A Fixed Annuity Might Fit Into Your Retirement Plan. The compounded annual formula can be used for investments such as savings accounts bonds and stocks. Ad Get this must-read guide if you are considering investing in annuities.

Where PV present value FV future value PMT payment per period i interest rate in percent per period N number of periods. Annuities are often complex retirement investment products. FVPMT 1i 1iN - 1i.

The present value of an annuity with continuous compounding calculates the present value of future periodic payments when interest is compounded continuously. Monthly Compound Interest 20000 1 1012 1012 20000.

Future Value Of An Annuity Annuity Teaching Mathematics

Annuity Payment Pv Formula With Calculator

Pv Annuity Calculator Store 53 Off Www Ingeniovirtual Com

Pv Of Annuity W Continuous Compounding Formula With Calculator

Present Value Of An Annuity How To Calculate Examples

Annuity Due Formula Example With Excel Template

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Annuity Formula Annuity Formula Annuity Economics Lessons

Future Value Of Annuity Formula With Calculator

Annuity Formula What Is Annuity Formula Examples

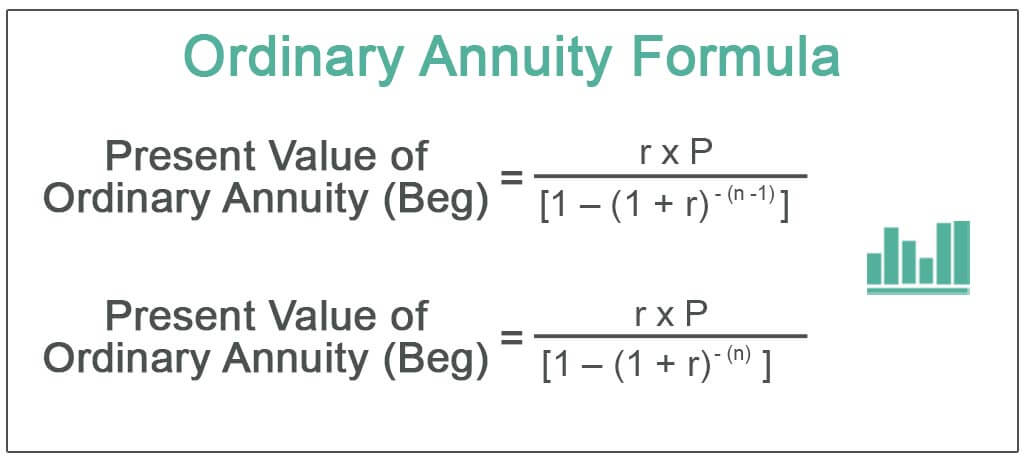

Ordinary Annuity Formula Step By Step Calculation

Future Value Of An Annuity Formula Example And Excel Template

Derive The Value Of An Annuity Formula Compounded Interest Youtube

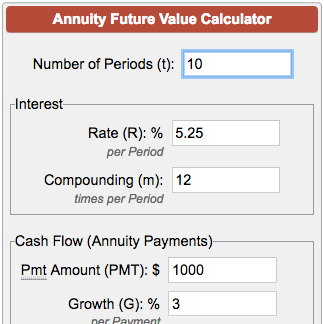

Future Value Of Annuity Calculator

Future Value And Interest Of Annuity Compounded Quarterly Youtube

Fv Of Annuity With Continuous Compounding Formula With Calculator